How Your Credit Score Works

Your Credit Score, Explained Simply

Your credit score can feel like a mystery number quietly influencing big life decisions — loans, interest rates, even rental applications. But it’s not magic, and it’s not permanent.

At MyMoneyMedic, we believe financial wellbeing starts with understanding. When you know how your credit score is built, you can take small, intentional steps to improve it — without stress, shame, or overwhelm.

This guide breaks down how credit scores work in Australia, what’s considered good or bad, and how you can start getting 1% better, every day.

How Is a Credit Score Calculated?

Your credit score is calculated using data from your credit report. While scoring models vary slightly, most are based on five core factors:

1. Payment History (≈35%)

This is the most important factor.

It looks at:

- Whether you pay bills and loans on time

- Missed payments, defaults, or court judgments

Even one late payment can have an impact, which is why consistency matters more than perfection.

2. Credit Utilisation (≈30%)

This measures how much credit you’re using compared to what’s available.

For example:

- $3,000 balance on a $10,000 limit = 30% utilisation

Lower utilisation shows lenders you’re not financially stretched.

3. Length of Credit History (≈15%)

The longer your accounts have been open, the more data lenders can see.

That’s why, where possible, keeping older accounts open can support your score — even if you don’t use them often.

4. Credit Mix (≈10%)

This reflects the types of credit you manage, such as:

- Credit cards

- Personal loans

- Car loans

- Home loans

A healthy mix shows you can manage different financial commitments responsibly.

5. New Credit & Enquiries (≈10%)

Every time you apply for credit, a hard enquiry is recorded.

Too many applications in a short period can signal financial stress — even if you’re approved.

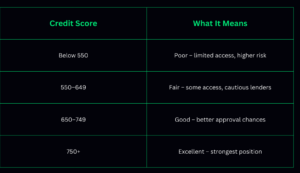

What’s a Good or Bad Credit Score in Australia?

While ranges differ slightly by bureau (Equifax, Experian, Illion), a general guide looks like this:

👉 Most Australians sit in the fair to good range, which means improvement is often achievable with the right habits.

Why Your Credit Score Matters

A healthier credit score can lead to:

- Lower interest rates

- Easier loan approvals

- More financial flexibility

- Less money stress overall

Importantly, your credit score isn’t just about borrowing — it’s about financial confidence and choice.

Tips: How to Improve Your Credit Score

Here are practical, realistic steps you can start today:

✅Pay Bills on Time

Set up direct debits or reminders to avoid missed payments.

✅ Keep Credit Card Balances Low

Aim to stay under 30% of your credit limit.

✅ Check Your Credit Report Regularly

Errors happen. Reviewing your report helps you catch mistakes early.

You can access free reports through providers like:

✅ Limit Credit Applications

Be selective. Apply for credit only when necessary.

✅ Build Better Habits, Not Quick Fixes

Credit improvement is a process. Small changes, repeated consistently, create momentum.

How MyMoneyMedic Can Help

At MyMoneyMedic, we don’t just focus on numbers — we focus on people.

Our PulseCheck helps you:

- Understand where you currently sit

- Identify priority actions

- Build healthier financial habits over time

Because financial wellbeing isn’t about judgment — it’s about support, clarity, and progress.

👉 Start with awareness. Aim for progress. Get 1% better, every day.

Final Thoughts: Progress Over Perfection

Your credit score is not a reflection of your worth.

It’s a snapshot of financial behaviour — and behaviour can change.

With the right knowledge, support, and small consistent steps, improvement is possible. And you don’t have to do it alone.

💙 That’s what MyMoneyMedic is here for.